Discover how seniors can find peace of mind with cost-effective life insurance options. Uncover the factors that influence premiums, compare policy types, and learn valuable tips for securing the right coverage to protect your loved ones and legacy.

![]()

Understanding Life Insurance for Seniors

As we enter our golden years, it's natural to reflect on the legacy we'll leave behind and how we can continue to protect our loved ones. Life insurance for seniors is a crucial consideration that can provide financial security and peace of mind. In this comprehensive guide, we'll explore the world of life insurance for older adults, focusing on affordable options that offer substantial coverage.

The Importance of Life Insurance for Seniors

Many seniors wonder if life insurance is still necessary once they've reached retirement age. The truth is, life insurance can serve several important purposes for older adults:

- Cover final expenses, including funeral costs and medical bills

- Leave a financial legacy for children or grandchildren

- Pay off any remaining debts or mortgage balances

- Provide income replacement for a surviving spouse

- Fund charitable donations or establish a trust

With these potential benefits in mind, it's clear that life insurance can play a vital role in your overall financial planning, even in your later years.

Types of Life Insurance Policies for Seniors

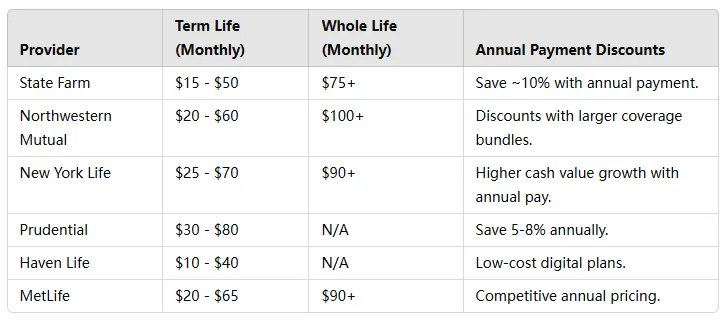

Here are the most common options for seniors, their typical costs, and benefits:

- Term Life Insurance

Term life insurance provides coverage for a specific period, usually 10, 15, or 20 years. This can be an affordable option for seniors who want coverage for a limited time, perhaps to coincide with the years left on a mortgage or to provide for dependents until they become financially independent. - Whole Life Insurance

Whole life insurance offers lifelong coverage and includes a cash value component that grows over time. While premiums are typically higher than term life insurance, the policy remains in force as long as premiums are paid, regardless of changes in health. - Guaranteed Universal Life Insurance

This type of policy combines elements of term and whole life insurance. It provides coverage for life (or up to a specific age, such as 95 or 100) with level premiums, often at a lower cost than traditional whole life insurance. - Final Expense Insurance

Also known as burial insurance, this type of policy is designed to cover end-of-life expenses. Coverage amounts are typically lower, ranging from $5,000 to $25,000, but policies are often easier to qualify for and can be more affordable for seniors on a fixed income.

Top Life Insurance Providers in the U.S. and Their Monthly/Annual Pricing

In the U.S., there are several well-known providers offering a range of policies tailored to meet diverse needs. Here's a closer look at the top life insurance providers and their pricing structures for monthly or annual payment plans.

1. State Farm

- Types of Policies: Term Life, Whole Life, Universal Life

- Pricing:

- Term Life Insurance:

- $15 - $50/month for $250,000 coverage (20-year term, healthy 30-year-old).

- $500 - $600/year for the same plan if paid annually.

- Whole Life Insurance: Starts at $75/month for $100,000 coverage.

- Term Life Insurance:

![]() * Notable Features: Personalized service through a vast network of agents, strong customer satisfaction, and the option to bundle life insurance with other policies for discounts.

* Notable Features: Personalized service through a vast network of agents, strong customer satisfaction, and the option to bundle life insurance with other policies for discounts.

2. Northwestern Mutual

- Types of Policies: Term Life, Whole Life, Variable Life

- Pricing:

- Term Life Insurance: $20 - $60/month for $250,000 coverage (20-year term, healthy 30-year-old).

- Whole Life Insurance: Starts at $100/month for $100,000 coverage, with flexible annual premium options.

![]() * Notable Features: Offers flexible coverage with a strong emphasis on cash value growth for permanent policies.

* Notable Features: Offers flexible coverage with a strong emphasis on cash value growth for permanent policies.

3. New York Life

- Types of Policies: Term Life, Whole Life, Universal Life, Variable Universal Life

- Pricing:

- Term Life Insurance: $25 - $70/month for $250,000 coverage (20-year term, healthy 40-year-old).

- Annual pricing: Around $800/year for the same term plan.

- Whole Life Insurance: Premiums starting at $90/month, with coverage amounts customizable based on the policyholder’s financial goals.

- Term Life Insurance: $25 - $70/month for $250,000 coverage (20-year term, healthy 40-year-old).

![]() * Notable Features: Offers dividend-earning whole life policies, enhancing cash value over time.

* Notable Features: Offers dividend-earning whole life policies, enhancing cash value over time.

4. Prudential

- Types of Policies: Term Life, Indexed Universal Life, Variable Universal Life

- Pricing:

- Term Life Insurance:

- $30 - $80/month for $250,000 coverage (20-year term, healthy 35-year-old).

- Annual pricing: Around $950/year.

- Term Life Insurance:

![]() * Notable Features: Known for accommodating individuals with pre-existing health conditions and offering policies that can adapt to changing needs.

* Notable Features: Known for accommodating individuals with pre-existing health conditions and offering policies that can adapt to changing needs.

5. Haven Life (MassMutual)

- Types of Policies: Term Life Insurance

- Pricing:

- Term Life Insurance:

- $10 - $40/month for $250,000 coverage (10 to 30 years, healthy 25-year-old).

- Annual pricing: $400/year on average.

- Term Life Insurance:

![]() * Notable Features: Fully digital application process, instant approvals for most policies, and competitive rates for young families.

* Notable Features: Fully digital application process, instant approvals for most policies, and competitive rates for young families.

6. MetLife

- Types of Policies: Term Life, Whole Life, Universal Life

- Pricing:

- Term Life Insurance: $20 - $65/month for $250,000 coverage (20-year term, healthy 30-year-old).

- Annual pricing for term plans starts at $700/year.

![]() * Notable Features: Offers robust group life insurance options for employers alongside individual policies.

* Notable Features: Offers robust group life insurance options for employers alongside individual policies.

Comparison of Typical Monthly Premiums

Factors Affecting Life Insurance Premiums

Factors Affecting Life Insurance Premiums

Age and Health

Premiums increase with age, so purchasing early can save significantly. Health issues can result in higher costs or limited policy options.

Gender

Women typically pay less than men due to longer life expectancy.

Smoking Status

Non-smokers can save up to 50% on premiums compared to smokers.

Coverage Amount and Policy Type

Higher coverage and comprehensive policies like whole life result in higher premiums.

Tips for Finding Affordable Life Insurance as a Senior

Now that we've covered the basics, let's explore some strategies for securing affordable life insurance coverage in your golden years:

- Compare Multiple Quotes

Don't settle for the first offer you receive. Shop around and get quotes from several insurance providers to ensure you're getting the best possible rate for your situation. - Consider a No-Medical-Exam Policy

If you have health concerns that might result in higher premiums or policy denial, look into no-medical-exam policies. While these may have slightly higher premiums, they can provide an accessible option for coverage. - Opt for a Smaller Coverage Amount

If your financial obligations have decreased over the years, you may not need as much coverage as you once did. Consider a lower coverage amount to reduce your premiums while still providing for your most essential needs. - Choose a Shorter Term

For term life insurance, selecting a shorter term can significantly reduce your premiums. Consider your specific needs and choose a term that aligns with your financial goals. - Improve Your Health

While some health factors are beyond our control, taking steps to improve your overall health can potentially lead to lower premiums. Quitting smoking, maintaining a healthy weight, and managing chronic conditions can all have a positive impact. - Consider Guaranteed Issue Policies

If you're having difficulty qualifying for traditional policies due to health issues, guaranteed issue policies may be an option. These typically have lower coverage amounts but are designed to provide coverage regardless of health status.

Money-Saving Tips for Senior Life Insurance

- Compare Providers

Get quotes from multiple insurers. Price differences for similar policies can be significant. - Opt for Simplified Issue Policies

No-medical-exam policies reduce the hassle for seniors with health concerns. - Choose a Smaller Coverage Amount

Opting for only the amount you need – say, to cover funeral costs – lowers premiums. - Pick Shorter Term Policies

For term life, a 10- or 15-year policy can reduce costs without compromising coverage. - Maintain Your Health

Improving health by quitting smoking or managing conditions can lead to better rates upon renewal. - Bundle Policies

Some insurers offer discounts if you combine life insurance with other coverage types, like home or auto insurance.

![]()

Understanding Policy Riders

When exploring life insurance options, it's important to understand policy riders – additional benefits that can be added to your base policy. Some riders that may be particularly relevant for seniors include:

Accelerated Death Benefit: Allows you to access a portion of your death benefit if you're diagnosed with a terminal illness.

Long-Term Care Rider: Provides coverage for long-term care expenses if needed.

Waiver of Premium: Waives your premiums if you become disabled and unable to work.

While riders can enhance your coverage, they also typically increase your premiums. Consider your specific needs and budget when deciding whether to add any riders to your policy.

The Application Process

When applying for life insurance as a senior, be prepared for the following steps:

Initial Quote: Provide basic information to receive a preliminary quote.

Application: Complete a more detailed application with information about your health, lifestyle, and beneficiaries.

Medical Exam (if required): Some policies may require a medical exam, which typically includes a physical and blood tests.

Underwriting: The insurer reviews your application and medical information to determine your risk level and final premium.

Policy Issuance: If approved, you'll receive your policy documents to review and sign.

The process can take anywhere from a few days to several weeks, depending on the type of policy and the insurer's requirements.

Reviewing and Updating Your Policy

Once you've secured a life insurance policy, it's important to review it periodically, especially if you experience significant life changes such as:

- Marriage or divorce

- Birth or adoption of grandchildren

- Changes in financial obligations

- Significant health changes

- Regularly reviewing your policy ensures that your coverage continues to meet your needs and that your beneficiary information is up to date.

Conclusion:

Life insurance for seniors is an important consideration that can provide peace of mind and financial security for you and your loved ones. By understanding the types of policies available, the factors that influence premiums, and strategies for finding affordable coverage, you can make an informed decision that aligns with your needs and budget.

Remember, the key is to start exploring your options sooner rather than later. While it's possible to find affordable coverage at any age, securing a policy earlier can often result in more favorable terms and lower premiums. Take the time to shop around, compare quotes, and consult with insurance professionals to find the right policy for your unique situation.

Ultimately, investing in life insurance as a senior is about more than just financial planning – it's about securing your legacy and ensuring that your loved ones are protected, no matter what the future may hold. With the right policy in place, you can enjoy your golden years with the confidence that comes from knowing you've taken important steps to safeguard your family's financial future.